WHAT IS CHARGEBACK MANAGEMENT?

A chargeback is a payment dispute that occurs when a cardholder asks their card-issuing bank to reverse a transaction.

WHAT HAPPENS WHEN A CHARGEBACK OCCURS?

When a consumer files a chargeback with their bank, the disputed funds associated with the transaction are collected from the merchant’s account until it is resolved. However, arriving at the resolution can be a complicated and time-consuming process, often taking several weeks or even months to resolve. Excessive chargeback levels can also have major ramifications to merchants, including operating restrictions, added fees and penalties, and in extreme cases based on chargeback ratio (frequency), result in blacklist.

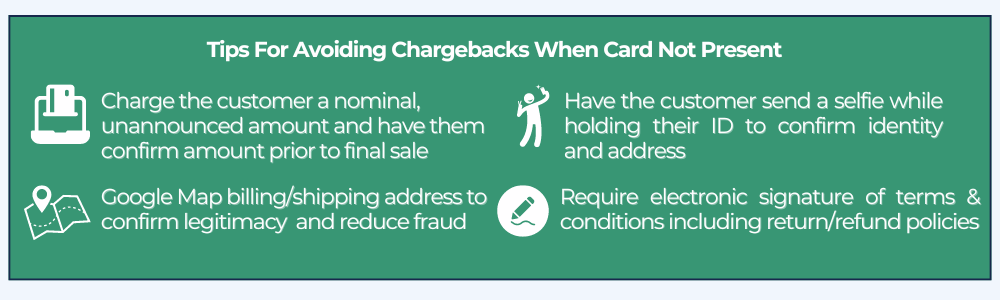

BEST PRACTICES TO AVOID CHARGEBACKS

Include an accurate merchant billing descriptor for credit card statements

A billing descriptor is the line item for a purchase that appears on the consumer’s statement. An accurate billing descriptor, which matches the business name, is critical.

Track all shipments

With package theft at an all-time high, merchants should track every order shipped, and for higher-value purchases, merchants may want to consider requiring a signature.

Ensure product descriptions are accurate

Items sold should always match the merchant’s detailed product description and images as they appear on the merchant’s website.

Provide Excellent Support

Merchants should provide clear direction on how customers can contact them for support.

Have clear documentation around recurring subscriptions

Customers can initiate a chargeback if they forget about automatic renewal. Ensure that customers clearly understand the parameters of recurring transactions upfront.